Client Profile:

- Type: Multiple Family Office

- AUM: $10 billion USD

Project Duration:

- 18+ months

Tags:

- Multiple Family Office, Single Family Office

- Own and Operate

- Data Sanitation

- Alternative Asset management

- Adhoc Consulting

Background

The client’s mission is to simplify and optimize the management of several small to medium family wealth management offices. They do this by providing best in class technology solutions, including Addepar, through a shared economy model. This approach offers cost-effective and discrete access to specialized technology, a professional network and a dedicated team to streamline operations and expand opportunities for family office.

Client Challenge:

The client reached out to us to help them with the management of shared Addepar instance for several of their small family office clients. Despite of creating a cost effective solution, Addepar shared instances come with their own specific challenges of maintaining different reporting structures across different family offices in a single Addepar Instance.

Elevate Advisory was tasked to streamline and manage the workflow for Shared instance of Addepar.

Our Solution:

Elevate Advisory took a comprehensive approach to resolve these issues and restore the client’s confidence in their Addepar instance.

- Implementation and Setup:

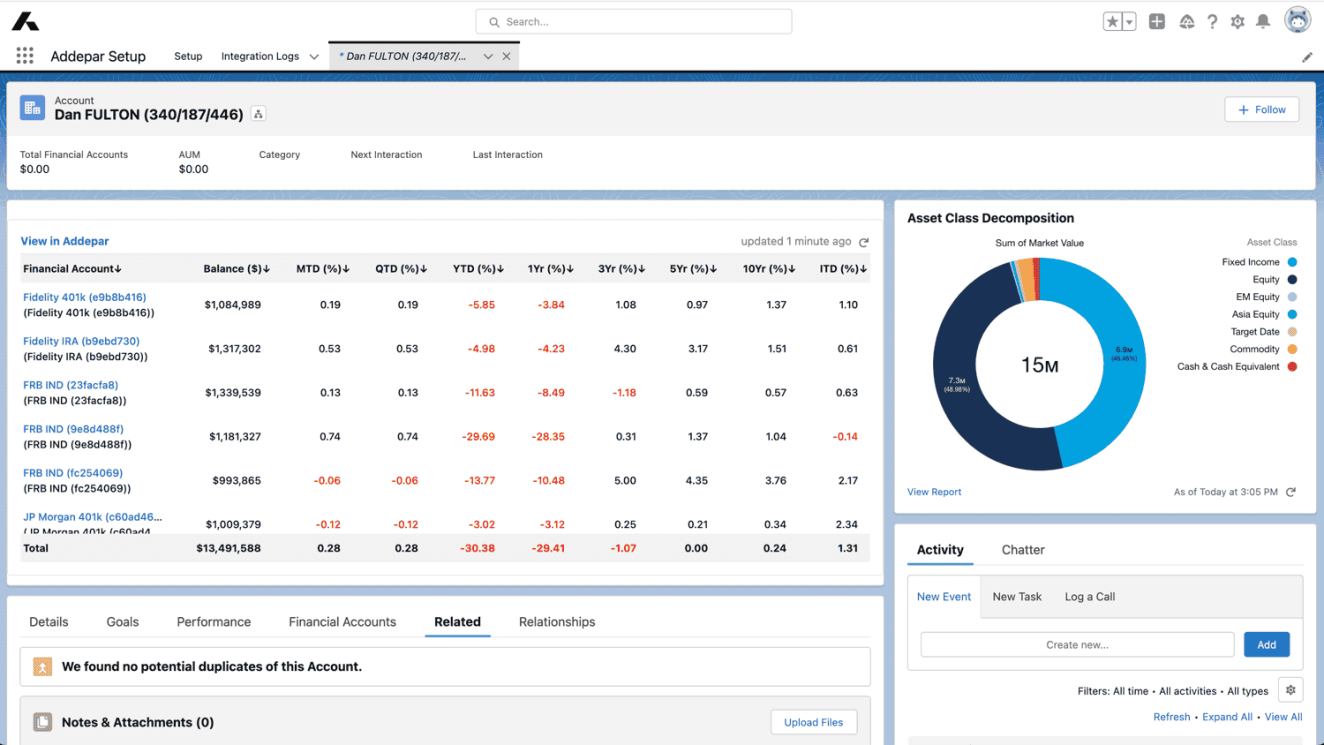

- Client Account Setup: We assisted in setting up new clients/accounts within the client's shared Addepar instance, allowing multiple family offices to benefit from the technology.

- Reporting and Auditing:

- Standardized Reporting Templates: We established standardized section templates for scalable auditing and reporting, ensuring consistent and accurate reports across all family offices.

- Attribute Setup: We configured necessary attributes for comprehensive reporting and auditing workflows, tailored to meet each family office's specific needs.

- Performance Audits: Systems were designed for auditing unusual performance, preventing discrepancies from appearing in client-facing reports.

- Alternative Investments:

- Audit and Maintenance: We conducted thorough audits and maintenance of alternative investments, ensuring accurate tracking and reporting of bond and stock returns.

- Data Privacy and Security:

- Secure Data Sharing: We implemented secure data sharing platforms to protect clients' data and identities, maintaining the highest standards of data privacy and security.

Results:

The collaboration resulted in a streamlined and standardized process for onboarding new clients, significantly reducing hassle and improving efficiency. Our implementation allowed the client to manage over 10 small and medium family offices with consistent and reliable reporting standards.

Metrics of Success:

- Time Saved: Reduced onboarding time by 30%

- Efficiency Increase: Improved reporting accuracy by 25%

- Error Reduction: Decreased reporting errors by 20%

Future Plans:

We continue to offer ad-hoc consultations and plan to introduce advanced analytics features to further enhance the client’s Addepar instance.

Conclusion:

Elevate Advisory’s expertise in Addepar implementations has been pivotal in helping family office advisory services manage their operations effectively and securely. By supporting the management of a shared Addepar instance, we have enabled our client to offer best-in-class technology solutions to their clients without compromising on quality or security.

If you are an advisory service providing consulting and advisory services to small to medium family offices or registered investment advisors (RIAs), we can help you standardize your Addepar instance for scalable onboarding and reporting needs for each of your clients.

Talk to us for more details.